Are you looking for a side gig that offers plenty of flexibility while providing consistent income? Try Instacart.

Grocery shopping usually means taking money out of your bank account, but it doesn't always have to be that way. For Instacart shoppers, it’s a chance to cash in! Workers make money by shopping for groceries at local stores.

Demand for Instacart shoppers, as well as other services like Postmates drivers, has skyrocketed. More people are staying home due to the coronavirus pandemic, but those picking and delivering groceries face risks to their health. Be sure to weigh the risks along with the benefits — extra cash and flexible hours — before signing up.

Pros & Cons

General Overview

What Is Instacart?

What Does Instacart Do?

Instacart is a grocery delivery service that partners with local stores to deliver items directly to customers’ homes. The service relies on independent contractors and part-time workers to fulfill and transport orders.

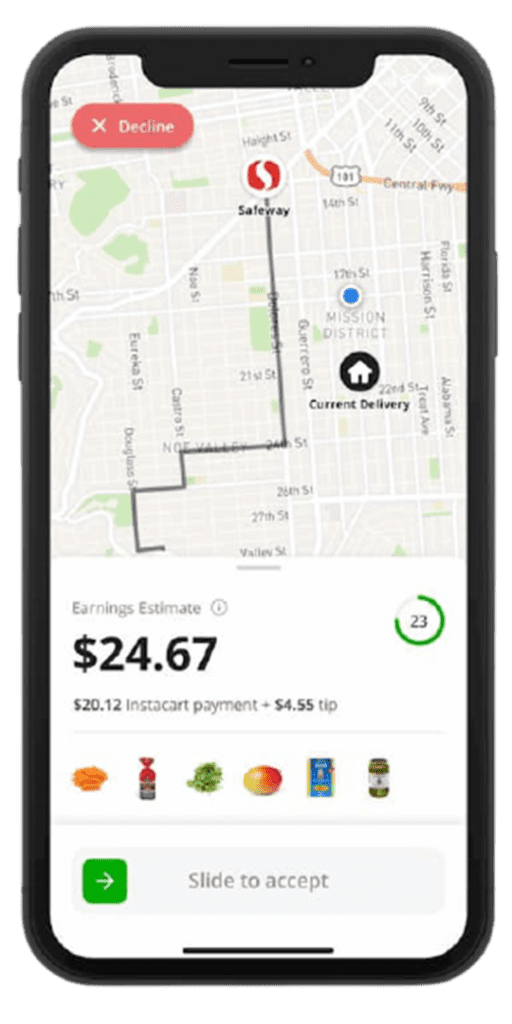

The hours are flexible and the orders come through Instacart’s Shopper app. The key details, like job responsibilities and the way you earn money, depend on whether you’re a full-service or in-store shopper.

Full Service Shopper

- Independent contractor

- Shop and deliver groceries

- Able to work an unlimited number of hours per week

- Role is available wherever Instacart operates

In Store Shopper

- Part-time employee

- In-store shopping only (no delivery & a car isn't required)

- Work at least 15 to 20 hours per week (includes the weekend)

- Get benefits, including 401(k) savings

- Temporary in-store shopper jobs are available in many areas to help meet increased demand. These positions are expected to last 90 days

Become A Shopper

How To Sign Up

- Download the Shopper app. You’ll provide basic information, like your name and location, and give the company permission to perform the background check. Later, you’ll use the app to set your availability, pick up gigs, track your earnings and communicate with Instacart’s help team if you encounter any issues.

- Attend an in-person orientation (in-store shoppers only). Choose a session in the app. This is part of the onboarding process.

- Fill out the paperwork. Independent contractors have to sign a contractor agreement and W-9 tax form. Part-time employees sign an offer letter and W-4 tax form.

- Register your Instacart payment card. Instacart shoppers use a preloaded payment card when they check out with a customer's order. New shoppers can expect to receive their card within 5 to 7 business days. Shoppers may have the option to pick up a card, depending on their location.

Where Can You Work

Where Can Instacart Work?

Instacart operates in more than 5,500 cities across the U.S. and Canada. Locations range from large urban areas such as San Francisco and New York to smaller communities such as Spring Creek, Nevada, and Lannon, Wisconsin.

To see whether there are full-service or in-store shopper openings in your area, download the Shopper app and enter your ZIP code.

How It Compares

How Does Instacart Compare To Others?

Understanding the difference between Instacart and other delivery services (i.e., Uber & DoorDash) is the first step while you are looking for a side hustle. With Instacart, you will shop and deliver only groceries. DoorDash lets you deliver food, drinks, and also goods from all the retailers available. And, with Lyft, you'll stay in your car, but you also will need to pick up passengers and drop them off at their desired location.

Payment

How Instacart Pays

Both in-store and full-service shoppers are paid weekly via direct deposit to a checking or savings account.

Full-service shoppers can use instant cash out, an immediate transfer to a debit card, to access their earnings more quickly. You can use instant cash out for the first time after completing five batches. After that, you can cash out at any time, as often as five times per day, as long as you have at least $5 in earnings. There’s a $3,000 daily limit.

Since full-service shoppers are considered independent contractors, they may have to make estimated quarterly tax payments. That’s because Instacart doesn’t withhold taxes from earnings like it does for part-time employees.

Rating